WAT Stock Analysis: A Mixed Outlook Ahead!

🔴 Recommendation: WAT is presenting a complex investment landscape with both bullish and bearish indicators, suggesting a cautious approach for investors.

📈 Key Highlights:

Positive Momentum: The stock is currently experiencing a confirmed buy signal from the WaveTrend indicator, indicating potential upward momentum.

Financial Health: Recent net income of $142.74 million showcases profitability, while year-over-year revenue growth of 11.26% reflects strong growth potential.

Institutional Support: With a high institutional ownership of 98.28%, major investors are showing confidence in the company’s long-term prospects.

⚠️ Caution Flags:

High Debt Levels: Average net debt stands at $1.97 billion, raising concerns about financial flexibility.

Liquidity Risks: A current ratio of 0.53 suggests potential challenges in meeting short-term obligations.

Overvaluation Concerns: The forward P/E ratio of 26.46 and a price-to-sales ratio of 6.95 indicate potential overvaluation.

As we delve deeper into the details, we will break down the price trends, indicators, financial health, valuation metrics, and more to provide a comprehensive analysis of WAT stock. Stay tuned! 👇

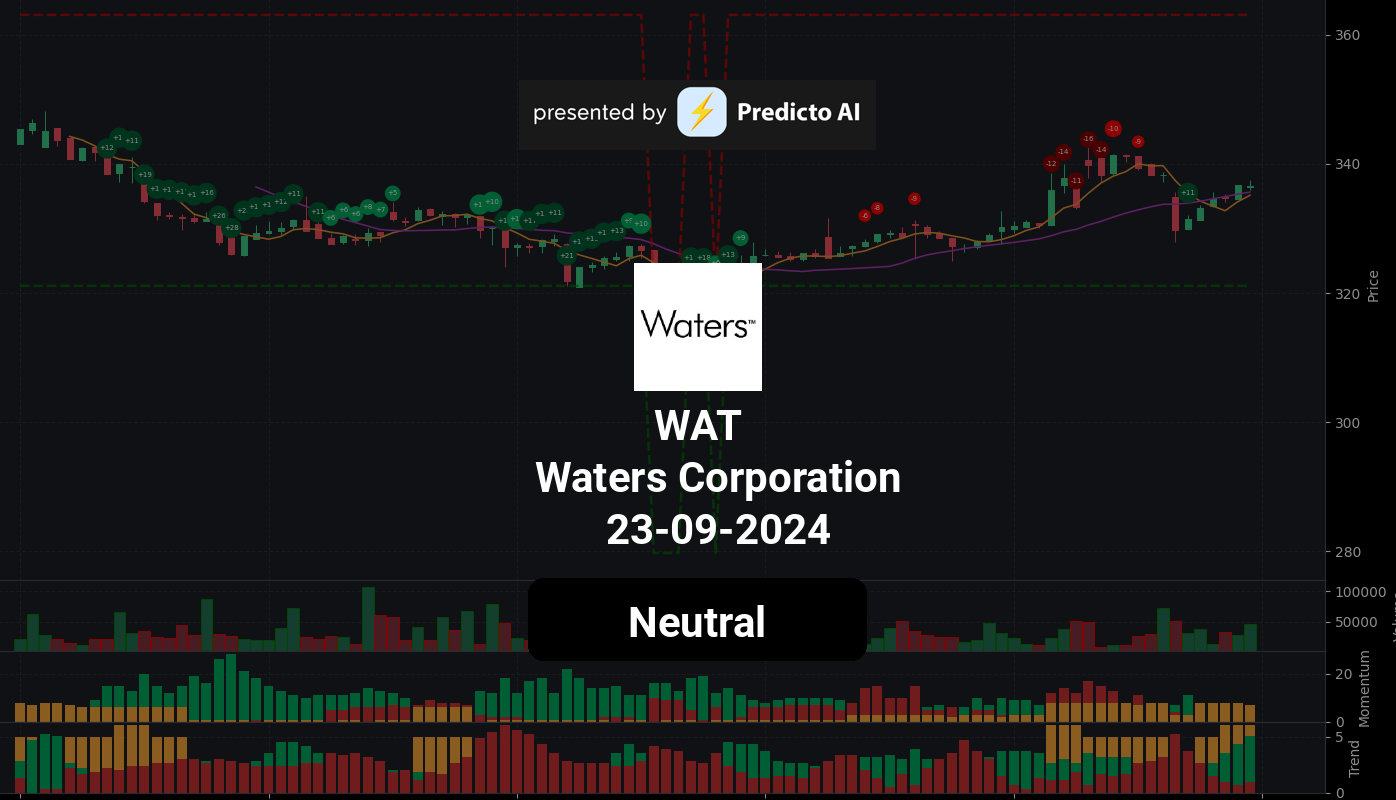

WAT Price Analysis

| Positive Momentum Signals | Negative Momentum Signals | Hold Momentum Signals |

|---|---|---|

|

|

| Positive Trend Signals | Negative Trend Signals | Hold Trend Signals |

|---|---|---|

|

|

|

WAT stock presents a complex picture for investors, characterized by both positive and negative indicators. On the positive side, the stock is currently experiencing a confirmed buy signal from the WaveTrend indicator, suggesting a potential upward momentum. Additionally, WAT’s price is above the middle band of its trading range, indicating an uptrend, although investors should remain cautious of possible overbought conditions. The stock is also above both the 50-day and 200-day exponential moving averages (EMAs), reinforcing a bullish trend, with the EMA 50 showing signs of strengthening. Furthermore, the MACD has recently shown a positive histogram crossover, which is another bullish signal.

However, there are notable concerns that investors should consider. The On-Balance Volume (OBV) is decreasing, indicating that the buying pressure may be waning, and high volume is also decreasing, which could suggest a lack of conviction in the current price movements. The Supertrend indicator is currently bearish, with the price trading below it, which raises caution about the sustainability of the upward trend.

In summary, while WAT stock has several bullish indicators, including a confirmed buy signal and strong positioning above key moving averages, the decreasing OBV and bearish Supertrend signal potential weaknesses. Investors should approach with caution, considering a hold strategy until clearer signals of sustained momentum emerge.

WAT Fundamental Analysis

WAT’s recent financial performance presents a mixed picture, highlighting both strengths and significant concerns. On the positive side, the company reported a net income of $142.74 million for the most recent period, indicating profitability. Additionally, the year-over-year increase in net income is a favorable sign, suggesting that the company is on a growth trajectory. The total revenue of $708.53 million and an impressive year-over-year revenue growth of 11.26% further underscore the company’s strong revenue base and growth potential. Moreover, an operating margin of 100.00% and a net profit margin of 20.15% reflect efficient operations and the ability to generate profits after expenses.

However, several red flags warrant caution. The company’s average net debt stands at $1.97 billion, which is relatively high and could impact financial flexibility. A current ratio of 0.53 raises concerns about liquidity, indicating potential challenges in meeting short-term obligations. Furthermore, the cash to total assets ratio of 0.08 suggests limited financial flexibility and increased vulnerability to economic shocks.

Valuation metrics also raise alarms, with a forward P/E ratio of 26.46 and a price-to-sales ratio of 6.95, both indicating potential overvaluation. The earnings growth of -5.90% is particularly concerning, as it signals a decline in earnings, which could deter investors.

In terms of shareholder information, the average ordinary shares outstanding is 59,200,200, indicating a stable shareholder base, while the average treasury shares of 103,548,200 may suggest management’s confidence through share buyback activity.

The income statement reveals a negative net interest income of -$19.40 million and an interest expense of $23.73 million, indicating that the company is paying more in interest on its debts than it is earning on its assets. Additionally, the debt-to-equity ratio of -2.89 and a negative average tangible book value of -$828.94 million raise concerns about potential financial distress.

On a more positive note, the company is investing in growth, as evidenced by average capital expenditures of $171.18 million and positive net cash from financing at $1.07 billion. The stock repurchases of $385.42 million could also signal management’s confidence in the company’s future prospects.

In summary, while WAT exhibits strong revenue growth and profitability margins, the high levels of debt, potential liquidity risks, and signs of overvaluation suggest a cautious approach. Investors should carefully evaluate the company’s ability to navigate these challenges before making any investment decisions.

Financial Health

🟢 Net Income for the most recent period was positive at $142.74 million, showing profitability.

🟢 Year-over-year net income increased, which is generally a positive sign.

🔴 Average Net Debt is high at $1.97 billion, warranting further investigation into its impact on financial flexibility.

🔴 Current Ratio of 0.53 suggests a potential liquidity risk, as the company might face challenges in meeting its short-term financial obligations.

🔴 Cash to Total Assets Ratio is low at 0.08, indicating limited financial flexibility and a higher vulnerability to economic shocks.

Valuation

🔴 Forward P/E ratio of 26.46 indicates potential future overvaluation.

🔴 Price-to-Sales Ratio of 6.95 suggests potential overvaluation.

🔴 Earnings Growth of -5.90% indicates a decline in earnings, which is a warning sign for investors.

Growth and Profitability

🟢 Total revenue for the most recent period was $708.53 million, indicating a strong revenue base.

🟢 Year-over-year revenue growth was 11.26%, indicating strong growth potential.

🟢 Operating Margin of 100.00% suggests efficient operations and good cost control.

🟢 Net Profit Margin of 20.15% reflects the company’s ability to generate profits after all expenses.

Shareholder Information

🟢 Average Ordinary Shares Outstanding is 59,200,200 shares, indicating a stable shareholder base.

🟢 Average Treasury Shares of 103,548,200 could indicate share buyback activity, potentially signaling management’s confidence in the company’s future prospects.

Income Statement

🟢 Net Interest Income was negative at -$19.40 million, but the effective tax rate of 15.70% is relatively low compared to the corporate tax rate.

🔴 Interest Expense was $23.73 million, which could indicate the company is paying more in interest on its debts than it is earning on its assets.

Balance Sheet

🔴 Debt-to-Equity Ratio of -2.89 suggests a moderate level of leverage, which may be sustainable depending on the company’s industry and profitability.

🔴 Average Tangible Book Value is negative at -$828.94 million, indicating potential financial distress.

Cashflow

🟢 Average Capital Expenditures of $171.18 million suggests the company is investing in growth and expansion.

🟢 Positive net cash from financing at $1.07 billion indicates the company is raising capital, which could be used for growth or debt reduction.

🟢 Stock Repurchases of $385.42 million can be a positive signal as it reduces the number of shares outstanding and may boost earnings per share (EPS).

Overall, while there are positive indicators such as revenue growth and profitability margins, the high levels of debt, potential liquidity risks, and signs of overvaluation suggest a cautious approach.

WAT News Analysis

A positive outlook for Waters Corporation (WAT) based on recent performance and strategic developments.

Summary of WAT news indicates a strong performance and positive sentiment surrounding Waters Corporation. The company has shown consistent growth, with shareholders earning a 7.1% CAGR over the last five years. Recent earnings reports have exceeded expectations, and the appointment of a new board member could enhance strategic direction. Overall, the news paints a favorable picture for investors considering WAT.

🟢 Waters Corporation (NYSE:WAT) shareholders have earned a 7.1% CAGR over the last five years, indicating strong long-term performance and investor confidence.

🟢 Analysts have been lifting their price targets for WAT, suggesting positive market sentiment and expectations for future growth.

🟢 The appointment of Heather Knight to the Board of Directors could bring fresh perspectives and strategic insights, potentially benefiting the company’s direction.

🟢 WAT reported second-quarter earnings that beat expectations, showcasing operational strength despite a year-over-year decline in sales.

🔴 However, the year-over-year sales decline may raise concerns about the company’s growth trajectory in the short term.

🟢 The overall sentiment from analysts and the market remains positive, indicating that WAT is well-positioned for continued growth.

WAT Holders Analysis

The stock of WAT presents a mixed outlook for the next month, primarily driven by its high institutional ownership and low insider ownership. While institutional interest is strong, the lack of insider confidence raises some concerns.

🟢 WAT has a very high institutional ownership at **98.28%**, indicating significant interest from large investors. This suggests that major institutions believe in the company’s long-term potential, which can provide stability and support for the stock price.

🔴 However, the **0.06% insider ownership** is notably low, which may indicate a lack of confidence from company management. This could lead to questions about the company’s future direction and decision-making processes.

🟡 The number of institutional holders stands at **1053**, reflecting a diversified ownership structure. This broad base can help mitigate volatility, but it also means that any significant selling by these institutions could impact the stock price negatively.

🟡 Recent insider transactions show a higher percentage of sales compared to purchases, with **6 purchases and 1 sale** in the last six months. This trend may suggest that insiders are not as bullish on the stock’s immediate prospects.

🔴 The overall sentiment from insider transactions leans towards caution, as the majority of activity appears to be sales rather than purchases. This could indicate that insiders are taking profits or reducing their exposure to the stock.

WAT Analyst Ratings

The analyst ratings for WAT show a mixed sentiment, with a total of 5 strong buy ratings, 0 buy ratings, 9 hold ratings, 1 sell rating, and no strong sell ratings over the last month. This indicates a cautious optimism among analysts, as the majority lean towards holding the stock rather than outright buying or selling.

🔴 The recent upgrades from Wells Fargo to Overweight and Leerink Partners to Outperform suggest a positive outlook, but the presence of numerous hold ratings indicates that many analysts are not fully convinced about the stock’s immediate potential.

🟡 In the past month, the stock has seen a significant number of hold ratings (18 in the previous month), which reflects a wait-and-see approach among analysts. This could be due to uncertainties in the market or company-specific challenges.

🟢 Given the recent upgrades and the overall sentiment, it is likely that WAT will see some positive movement in the next month, but the medium confidence level suggests that investors should remain cautious. A potential price target could be around a 5% increase from the current levels, depending on market conditions and company performance.

WAT Economic Analysis

Based on the US economic and market data:

🔴 The unemployment rate has increased to 4.3%, up from 4.1% in the previous month, indicating potential weakness in the labor market which could lead to reduced consumer spending.

🟡 Retail sales have shown a slight increase to 627,510, but the growth is not robust enough to suggest strong consumer confidence.

🔴 The Non-Farm Payroll data indicates a slowdown in job creation, with only 158,445 jobs added in July, which is lower than the previous month. This could negatively impact overall economic growth and corporate earnings.

🟢 The GDP remains relatively stable at 5737.189, suggesting that while growth is not accelerating, it is not in decline either. This stability can provide a foundation for companies like Waters Corporation.

🔴 The CPI data indicates inflationary pressures, which could lead to increased costs for Waters Corporation, impacting profit margins.

Overall, the mixed signals from the labor market and retail sales, combined with inflation concerns, suggest a cautious outlook for Waters Corporation’s stock price over the next month. The stock may experience volatility, but the fundamentals remain relatively stable.

Disclaimer

Investors may consider the AI predictions and news summaries as one factor in their investment decisions alongside their own research and risk tolerance.