WFC Stock Analysis: A Cautious Outlook Ahead!

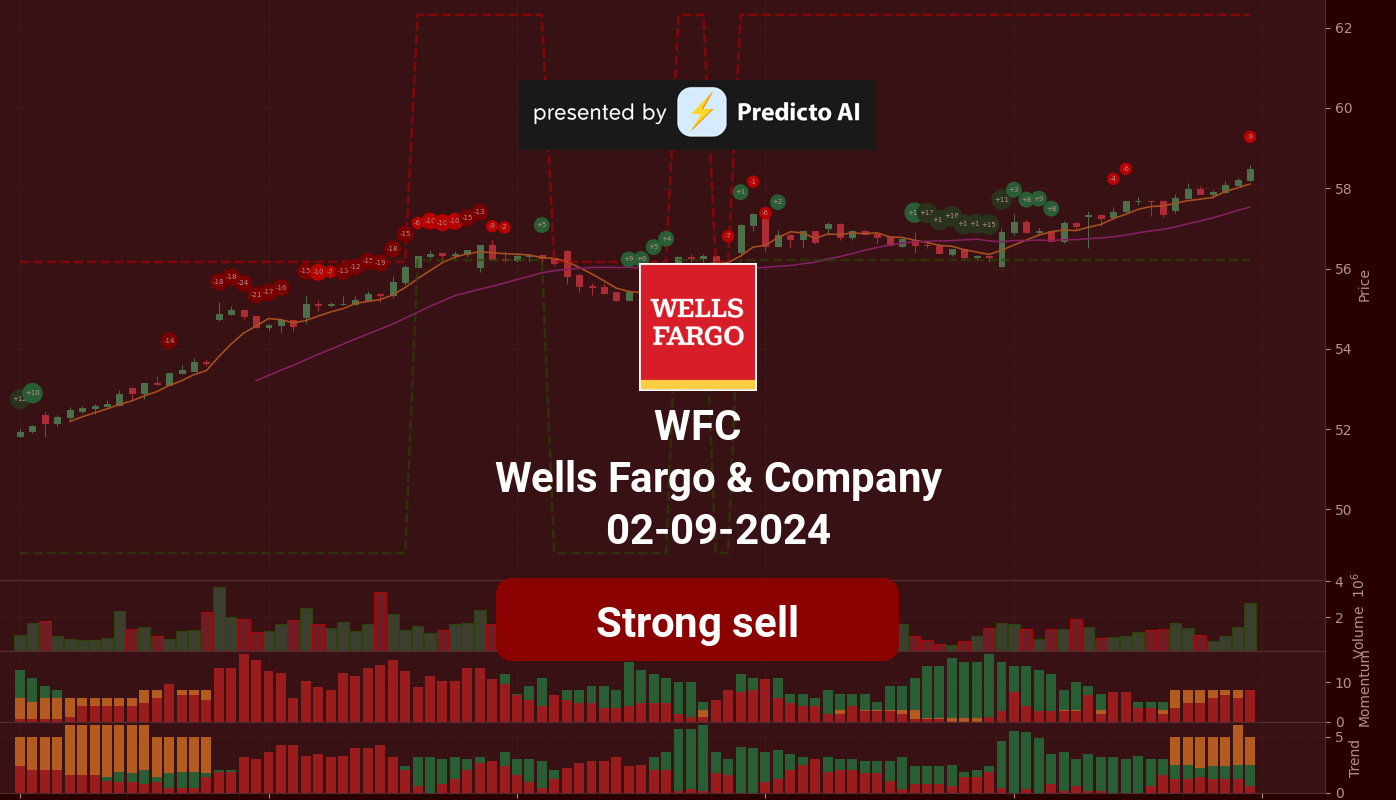

🔴 Recommendation: WFC is currently rated as a Strong Sell, reflecting significant caution for potential investors due to mixed signals in its financial indicators.

📈 Key Highlights:

Profitability: Positive net income of $4.91 billion, showcasing the company’s ability to generate profits.

Growth: Earnings growth of 6.40% indicates potential for future performance, despite a slight decline in year-over-year revenue.

Institutional Support: High institutional ownership at 76.60% suggests confidence from large investors in the company’s long-term prospects.

⚠️ Caution Flags:

High Debt: Average net debt of approximately $32.66 billion and a debt-to-equity ratio of 1.58 raise concerns about financial risk.

Overbought Conditions: Momentum indicators suggest that WFC may be overbought, indicating a potential price correction in the near future.

As we delve deeper into the analysis, we will explore the price trends, various indicators, financial health, valuation metrics, and more to provide a comprehensive view of Wells Fargo’s current standing and future outlook. Stay tuned for the detailed breakdown below! 👇

WFC Price Analysis

| Positive Momentum Signals | Negative Momentum Signals | Hold Momentum Signals |

|---|---|---|

|

|

| Positive Trend Signals | Negative Trend Signals | Hold Trend Signals |

|---|---|---|

|

|

WFC stock presents a complex financial picture, characterized by both bullish trends and concerning momentum indicators. Currently, the stock is rated as a strong sell, indicating significant caution for potential investors.

On the positive side, WFC shows several bullish trend indicators. The stock price has recently experienced a breakout above the upper Bollinger Band on high volume, which typically signals a potential upward trend. Additionally, the stock is trading above both the 50-day and 200-day exponential moving averages (EMAs), reinforcing a bullish trend. The On-Balance Volume (OBV) is also increasing, suggesting that buying pressure is strong, and the Supertrend indicator confirms the bullish sentiment as the price remains above it.

However, the momentum indicators tell a different story. The stock is currently touching or outside the upper Bollinger Band, which may indicate that it is potentially overbought. Both the Stochastic RSI and the Relative Strength Index (RSI) are in the overbought territory, raising concerns about a possible price correction in the near future. These negative momentum indicators suggest that while the stock has shown strength, it may be due for a pullback.

Given these mixed signals, investors should approach WFC with caution. The strong bullish trend indicators suggest potential for further gains, but the overbought conditions signal that a correction could be imminent. Therefore, a strong sell recommendation is warranted, particularly for those who may be considering entering a new position. Existing investors might want to consider tightening stop-loss orders to protect against potential downside risks.

WFC Fundamental Analysis

WFC’s recent financial performance presents a mixed picture, prompting a neutral outlook for the stock. On the positive side, the company reported a net income of $4.91 billion for the most recent period, indicating profitability. Additionally, the year-over-year increase in net income is a favorable sign for the company’s financial health. The current ratio of 6.86 reflects a strong liquidity position, suggesting that WFC can comfortably cover its short-term liabilities.

However, several concerns warrant caution. The average net debt of approximately $32.66 billion is high, which raises questions about the company’s financial flexibility. Furthermore, a debt-to-equity ratio of 1.58 indicates that WFC is highly leveraged, posing potential financial risks. The cash to total assets ratio of 0.12 is low, suggesting limited financial flexibility and increased vulnerability to economic shocks.

In terms of valuation, the forward P/E ratio of 10.61 suggests that the stock may be undervalued relative to its earnings potential. However, the price-to-sales ratio of 2.54 is moderate, indicating that while the stock is not overly expensive, caution is warranted.

Growth metrics reveal a year-over-year revenue decline of -0.83%, which could negatively impact future stock performance. On a positive note, WFC boasts an operating margin of 100.00% and a net profit margin of 23.73%, reflecting efficient operations and strong profitability. Additionally, an earnings growth rate of 6.40% suggests positive momentum for future performance.

Shareholder information indicates that WFC has engaged in stock repurchases of approximately $11.94 billion, which can enhance earnings per share by reducing the number of shares outstanding. However, the average ordinary shares outstanding at approximately 3.56 billion raises potential dilution concerns if new shares are issued.

From an income statement perspective, WFC’s net interest income of approximately $11.92 billion is a positive indicator, while the interest expense of approximately $10.96 billion is significant and could impact net income if not managed effectively. The effective tax rate of 20.30% is relatively low, which is beneficial for net income.

On the balance sheet, the average total debt of approximately $202.33 billion requires further analysis to understand its composition and terms, which could affect financial health. The average tangible book value of approximately $128.13 billion indicates a solid equity base, while the average treasury shares of approximately 1.92 billion could reflect share buyback activity, necessitating an assessment of its impact on cash reserves.

Finally, the cash flow analysis shows net cash from financing of approximately $74.29 billion, indicating that the company is raising capital, which could be utilized for growth or debt reduction. Positive net cash flow from financing activities is a good sign for WFC’s ability to fund operations and growth initiatives.

In summary, while WFC demonstrates strong profitability and efficient operations, concerns regarding revenue decline, high debt levels, and financial risk lead to a neutral stance on the stock at this time. Investors should carefully consider these factors before making any investment decisions.

Financial Health

🟢 Net Income for the most recent period was positive at $4.91 billion, indicating profitability.

🟢 Year-over-year net income increased, which is a positive sign for the company’s financial health.

🔴 Average Net Debt is high at approximately $32.66 billion, warranting further investigation into its impact on financial flexibility.

🔴 Debt-to-Equity Ratio of 1.58 raises concerns about financial risk, suggesting the company is highly leveraged.

🟢 Current Ratio of 6.86 indicates a healthy liquidity position, suggesting the company can comfortably cover its short-term liabilities.

🔴 Cash to Total Assets Ratio is low at 0.12, indicating limited financial flexibility and a higher vulnerability to economic shocks.

Valuation

🟢 Forward P/E ratio of 10.61 suggests potential undervaluation, indicating that the stock may be trading at a lower price relative to its earnings potential.

🔴 Price-to-Sales Ratio of 2.54 is moderate, suggesting that the stock is not overly expensive but warrants caution.

Growth and Profitability

🔴 Year-over-year revenue growth was -0.83%, indicating a decline in revenue, which could negatively impact the stock price.

🟢 Operating Margin of 100.00% suggests efficient operations and good cost control.

🟢 Net Profit Margin of 23.73% reflects the company’s ability to generate profits after all expenses, indicating strong profitability.

🟢 Earnings Growth of 6.40% suggests positive growth momentum, which is a good sign for future performance.

Shareholder Information

🟢 Stock Repurchases of approximately $11.94 billion can be a positive signal as it reduces the number of shares outstanding and may boost earnings per share (EPS).

🔴 Average Ordinary Shares Outstanding at approximately 3.56 billion indicates potential dilution concerns if shares are issued.

Income Statement

🟢 Net Interest Income of approximately $11.92 billion is a positive sign for the company, indicating income generated from interest-bearing assets.

🔴 Interest Expense of approximately $10.96 billion is significant and could impact net income if not managed properly.

🟢 Effective Tax Rate of 20.30% is relatively low compared to the corporate tax rate, which is beneficial for net income.

Balance Sheet

🔴 Average Total Debt of approximately $202.33 billion requires further analysis to understand its composition and terms, which could impact financial health.

🟢 Average Tangible Book Value of approximately $128.13 billion represents the net worth of the company after deducting liabilities from assets, indicating a solid equity base.

🔴 Average Treasury Shares of approximately 1.92 billion could indicate share buyback activity, but it is crucial to assess the impact on cash reserves and financial flexibility.

Cashflow

🟢 Net Cash from Financing of approximately $74.29 billion indicates the company is raising capital, which could be used for growth or debt reduction.

🟢 Positive net cash flow from financing activities is a good sign for the company’s ability to fund operations and growth initiatives.

Overall, while there are positive indicators such as strong profitability and efficient operations, concerns about revenue decline, high debt levels, and financial risk warrant a neutral stance on the stock at this time.

WFC News Analysis

A mixed outlook for Wells Fargo (WFC) based on recent news.

Summary of WFC news indicates a blend of positive and negative developments. While the reaffirmation of sponsorship and the company’s resilience in a challenging market are encouraging, concerns about low interest rates on idle cash and broader banking issues could weigh on investor sentiment. Investors should weigh these factors carefully.

🟢 Wells Fargo has reaffirmed its commitment as the official bank sponsor for the 2024 Orange Blossom Classic, showcasing its community engagement and brand visibility.

🔴 However, big banks, including Wells Fargo, are facing criticism for paying low rates on idle cash, which could lead to customer dissatisfaction and potential loss of deposits.

🔴 Additionally, there are concerns regarding co-brand card relationships struggling, which may impact revenue streams.

🟢 Despite these challenges, WFC has shown resilience, increasing in value even as the broader market slips, indicating some investor confidence.

🔴 The news about Warren Buffett selling Bank of America stock could create uncertainty in the banking sector, affecting WFC’s stock performance.

🟢 Overall, WFC remains a trending stock, suggesting that it is still on the radar of investors, but caution is advised due to the mixed signals from the market.

WFC Holders Analysis

The financial health of WFC shows a mixed outlook, with strong institutional backing but concerning insider ownership levels.

🟢 WFC has a high institutional ownership at **76.60%**, indicating significant interest from large investors, which often correlates with stability and confidence in the company’s future performance. Major holders like Vanguard Group and Blackrock have substantial stakes, suggesting they believe in the company’s long-term prospects.

🔴 However, the **insider ownership is only 0.08%**, which is very low. This could indicate a lack of confidence from company management or a high degree of external control, raising concerns about the alignment of interests between management and shareholders.

🟡 The number of institutional holders is **2767**, reflecting widespread interest and diversification in ownership. This could help mitigate volatility, but the high concentration of institutional ownership also means that any significant sell-off by these investors could lead to increased price volatility.

🟡 Recent insider transactions show a pattern of selling, which could be interpreted as a lack of confidence from those closest to the company. However, the absence of significant insider purchases in the last six months raises questions about the management’s outlook on the company’s future.

🔴 The overall market conditions and economic factors affecting the financial sector could impact WFC’s performance in the coming month. Analysts predict a potential price range of **$40 to $45** based on current trends and market sentiment.

In summary, while the institutional backing is a positive sign, the low insider ownership and recent selling activity warrant a cautious approach. Therefore, a **buy** recommendation is appropriate, but investors should remain vigilant about potential volatility.

WFC Analyst Ratings

The analyst ratings for WFC indicate a mixed sentiment, with a notable number of hold ratings. Currently, there are 4 strong buy ratings, 8 buy ratings, 15 hold ratings, and 4 sell ratings, with no strong sell ratings. This suggests a cautious optimism among analysts. 🟡 Over the past month, the trend shows a slight decrease in strong buy recommendations, which may indicate some hesitance in the market.

🟢 Despite the mixed ratings, the absence of strong sell recommendations and the presence of buy ratings suggest that WFC has potential for growth in the near term. However, the medium confidence level indicates that investors should remain vigilant about market conditions and company performance.

WFC Economic Analysis

Based on the US economic and market data:

🔴 The unemployment rate has increased to 4.3%, which may indicate a weakening labor market. This could lead to reduced consumer spending, negatively impacting Wells Fargo’s loan and mortgage segments.

🟡 Retail sales have shown a slight increase, but the growth is modest at 3.5% compared to previous months. This suggests that while consumers are still spending, the pace is not robust enough to drive significant growth in banking revenues.

🟢 The GDP growth rate remains stable, indicating that the overall economy is not in recession. This stability can support Wells Fargo’s diversified banking services, but it may not lead to substantial stock price increases in the short term.

🔴 The rising Treasury yield at 4.25% could lead to higher borrowing costs, which may deter consumers from taking loans, further impacting Wells Fargo’s profitability.

🟡 The overall market indices, including the S&P 500 and NASDAQ, have shown mixed signals, indicating uncertainty in the financial sector, which could affect investor sentiment towards WFC.

In summary, while there are some positive indicators, the overall economic environment presents challenges that may limit significant upward movement in Wells Fargo’s stock price over the next month. The price is likely to fluctuate around the current levels, with potential resistance near 60 and support around 55.

Disclaimer

Investors may consider the AI predictions and news summaries as one factor in their investment decisions alongside their own research and risk tolerance.