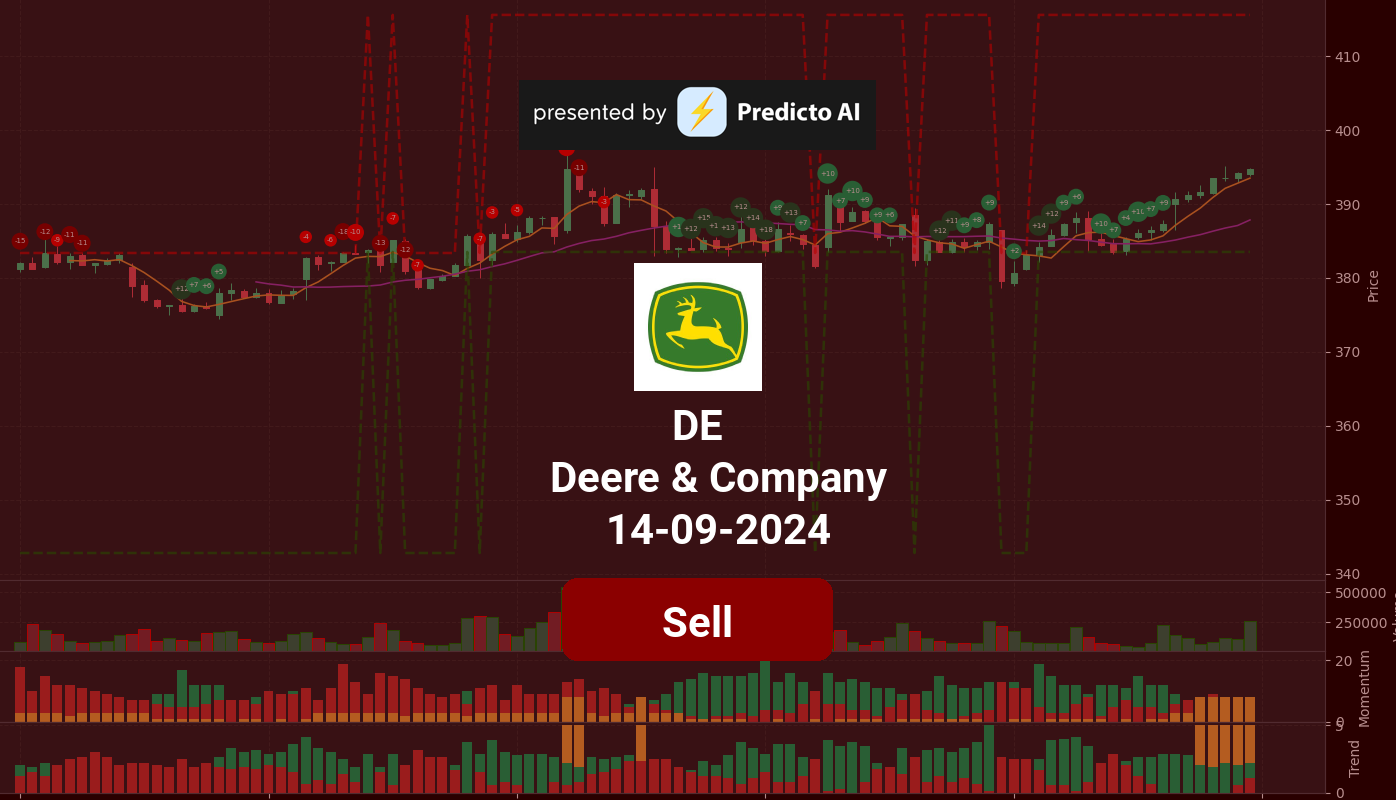

DE Stock Analysis: A Cautious Outlook Ahead!

🔴 Recommendation: DE is currently signaling a Strong Sell with a mix of concerning indicators that outweigh the positives.

📈 Key Highlights:

Trend Analysis: DE shows a strong bullish trend, trading above both the 50-day and 200-day EMA, but is currently at a sell signal.

Volume Support: The On-Balance Volume (OBV) is increasing, indicating strong buying interest despite the sell signal.

Financial Health: Recent net income of $1.73 billion is overshadowed by a year-over-year decline, raising profitability concerns.

⚠️ Caution Flags:

High Debt Levels: A staggering Debt-to-Equity Ratio of 3.70 suggests significant financial leverage and risk.

Liquidity Risks: A low Current Ratio of 0.77 indicates challenges in meeting short-term obligations.

Overbought Conditions: The Stochastic RSI indicates that DE may be overbought, signaling potential for a price correction.

As we delve deeper into the analysis, we will explore the price trends, various indicators, financial health, valuation metrics, and more to provide a comprehensive view of DE’s current standing and future prospects. Stay tuned for the detailed breakdown below! 👇

DE Price Analysis

| Positive Momentum Signals | Negative Momentum Signals | Hold Momentum Signals |

|---|---|---|

|

|

| Positive Trend Signals | Negative Trend Signals | Hold Trend Signals |

|---|---|---|

|

|

|

DE stock presents a complex financial picture, characterized by both positive and negative indicators. Currently, the stock is trading at a sell signal, which raises concerns for potential investors.

On the positive side, DE shows a strong bullish trend, with the price consistently above both the 50-day and 200-day EMA, indicating a solid upward trajectory. The On-Balance Volume (OBV) is increasing, supported by high volume, which typically suggests strong buying interest. Additionally, the price is above the Supertrend indicator, reinforcing the bullish sentiment. However, caution is warranted as the stock is currently below the Upper Band but above the Middle Band, indicating an uptrend that may be approaching overbought conditions.

Conversely, there are significant negative momentum indicators to consider. The Money Flow Index (MFI) shows a bearish divergence, suggesting that despite the price increase, the buying pressure may be weakening. The Stochastic RSI indicates that the stock is overbought, which could lead to a price correction. Furthermore, the MACD has shown a negative histogram crossover, signaling potential weakness in the momentum.

In summary, while DE stock exhibits a bullish trend with strong volume and price support, the presence of overbought conditions and negative momentum indicators suggests that investors should exercise caution. Given the current sell signal and the mixed indicators, a sell recommendation is prudent until clearer signs of a sustainable upward movement emerge.

DE Fundamental Analysis

DE’s recent financial performance raises significant concerns for investors. The company’s net income for the most recent period stands at $1.73 billion; however, the year-over-year trend shows a troubling decrease, which casts doubt on future profitability.

The debt-to-equity ratio is alarmingly high at 3.70, indicating substantial financial leverage that could pose risks during economic downturns. Additionally, a current ratio of 0.77 suggests liquidity challenges, making it difficult for the company to meet its short-term obligations. The cash to total assets ratio is only 0.06, highlighting limited financial flexibility and increased vulnerability to economic shocks.

From a valuation perspective, the forward P/E ratio of 17.30 implies that the stock may be overvalued, especially in light of a declining earnings growth rate of -38.30%. The price-to-sales ratio of 1.93 further indicates that the stock might be priced high relative to its sales, particularly given a revenue growth decline of -16.80%.

The company’s growth and profitability metrics are equally concerning. A revenue growth rate of -14.33% signals a significant decline in business performance, while the operating margin, although high at 100.00%, is misleading due to the overall negative trends in revenue and net income. The net profit margin of 13.50% reflects some ability to generate profits after expenses, but this is overshadowed by the declining revenues.

In terms of shareholder information, the average ordinary shares outstanding is 279,422,640, and fluctuations in this number could impact stock price. The high number of treasury shares (257,008,564) suggests that management’s confidence in the company’s current financial situation may not be strong. Furthermore, high short interest indicates bearish sentiment among investors, reflecting widespread concerns about the company’s future performance.

The income statement reveals a year-over-year revenue decline of -14.33%, which is alarming and indicative of a deteriorating business. The significant decrease in net income year-over-year raises red flags about the company’s profitability trajectory.

On the balance sheet, the average net debt of $57.61 billion is concerning, particularly in light of the high debt-to-equity ratio. The average total debt of $64.27 billion further emphasizes the financial risks the company faces. Additionally, an average tangible book value of $17.38 billion suggests limited net worth after liabilities, which could negatively impact investor confidence.

In terms of cash flow, the average capital expenditures of $3.37 billion indicate some investment in growth; however, this may not be sustainable given the current financial challenges. While net cash from financing is positive at $20.82 billion, it raises concerns about the company’s reliance on external financing to support operations.

Overall, the combination of declining revenues, high debt levels, and liquidity risks leads to a strong sell recommendation for DE stock. Investors should exercise caution and thoroughly evaluate the company’s ability to navigate its challenges before considering any investment.

Financial Health

🔴 Net Income for the most recent period was $1.73 billion, but the year-over-year net income trend shows a decrease, raising concerns about future profitability.

🔴 The Debt-to-Equity Ratio is extremely high at 3.70, indicating significant financial leverage and potential risk in economic downturns.

🔴 Current Ratio is low at 0.77, suggesting liquidity risk and challenges in meeting short-term obligations.

🔴 Cash to Total Assets Ratio is only 0.06, indicating limited financial flexibility and vulnerability to economic shocks.

Valuation

🔴 Forward P/E ratio of 17.30 suggests the stock may be overvalued given the declining earnings growth of -38.30%.

🔴 Price-to-Sales Ratio of 1.93 indicates that the stock might be priced high relative to its sales, especially with revenue growth at -16.80%.

Growth and Profitability

🔴 Revenue Growth of -14.33% indicates a significant decline in revenue, which is a warning sign for investors.

🔴 Operating Margin is high at 100.00%, but this is misleading given the overall negative trends in revenue and net income.

🟢 Net Profit Margin of 13.50% reflects the company’s ability to generate profits after expenses, but this is overshadowed by declining revenues.

Shareholder Information

🔴 Average Ordinary Shares Outstanding is 279,422,640, and fluctuations could impact stock price, but the high number of treasury shares (257,008,564) suggests management’s confidence may not be strong given the current financial situation.

🔴 High short interest could indicate bearish sentiment among investors, reflecting concerns about the company’s future performance.

Income Statement

🔴 Year-over-year revenue growth of -14.33% is alarming and indicates a declining business.

🔴 The significant decrease in net income year-over-year raises red flags about the company’s profitability trajectory.

Balance Sheet

🔴 Average Net Debt is $57.61 billion, which is concerning given the company’s high debt-to-equity ratio.

🔴 Average Total Debt of $64.27 billion further emphasizes the financial risk the company is under.

🔴 Average Tangible Book Value of $17.38 billion suggests limited net worth after liabilities, which could impact investor confidence.

Cashflow

🟢 Average Capital Expenditures of $3.37 billion indicate investment in growth, but this may not be sustainable given the current financial challenges.

🔴 Net Cash from Financing of $20.82 billion is positive, but it raises concerns about reliance on external financing to support operations.

Overall, the combination of declining revenues, high debt levels, and liquidity risks leads to a strong sell recommendation for this stock.

DE News Analysis

Recent news surrounding Deere & Company (DE) presents a mixed outlook for investors. While there are positive indicators from the broader market trends and gold prices, the uncertainty regarding the Fed’s rate decision and its implications on commodities could create volatility. Investors should remain cautious and consider the potential impacts on DE’s performance.

🟢 The Nasdaq and other stocks have seen major weekly gains ahead of the Fed’s decision, indicating a positive sentiment in the market.

🟢 This bullish trend in the stock market could benefit DE as investor confidence rises.

🔴 However, gold hitting record highs suggests that investors may be seeking safety in precious metals, which could divert attention from equities like DE.

🔴 The upcoming Fed rate decision is expected to have significant impacts on various commodities, including gold and oil, which could indirectly affect DE’s market position.

🟢 Analysts suggest that gold may continue to see upside, which could lead to increased investment in commodities rather than industrial stocks like DE.

🔴 Goldman Sachs has lowered its copper price target but remains bullish on gold, indicating a shift in focus that may not favor DE’s agricultural machinery sector.

🟢 Overall, the sentiment around gold and the stock market’s performance could lead to fluctuations in DE’s stock price in the coming month.

DE Holders Analysis

The financial landscape for DE indicates a mixed outlook for the next month. While there are positive aspects, certain factors warrant caution.

🟢 DE has a **high institutional ownership** at **79.95%**, indicating strong interest from large investors, which typically suggests confidence in the company’s future performance. This level of institutional backing can provide stability and support for the stock price.

🟡 The **very low insider ownership** at **0.17%** raises concerns about management’s confidence in the company’s prospects. This could imply a lack of alignment between management and shareholders, which is often viewed negatively by the market.

🟡 The **number of institutional holders** is substantial at **2785**, suggesting a diversified ownership base. This can mitigate volatility, but it also means that any significant selling by these institutions could lead to price fluctuations.

🔴 Recent **insider transactions** show minimal activity, with a few sales but no significant purchases. This lack of insider buying could indicate that management does not foresee immediate positive developments, which might dampen investor sentiment.

🔴 The **high institutional ownership** could lead to increased volatility if large investors decide to sell, especially in a market downturn. This is a risk factor that investors should consider.

In summary, while DE has strong institutional backing, the low insider ownership and mixed signals from insider transactions suggest a cautious approach. The stock may experience fluctuations in the coming month, and investors should monitor institutional activity closely.

DE Analyst Ratings

The analyst ratings for DE indicate a mixed sentiment, with a notable number of hold ratings. In the past month, there have been 5 strong buy ratings, 8 buy ratings, 11 hold ratings, and no sell or strong sell ratings. This suggests a generally positive outlook, but the significant number of hold ratings indicates some caution among analysts. 🟡

The recent upgrades from firms like Truist Securities and Morgan Stanley maintaining their Overweight rating suggest a level of confidence in DE’s performance. However, the presence of 14 hold ratings over the last month indicates that many analysts are waiting for clearer signals before making stronger recommendations.

🟢 Given the current analyst sentiment and the lack of negative ratings, it is likely that DE will see moderate performance in the next month, with potential for growth. A price target of around $400 could be reasonable, considering the current trading levels and analyst expectations. However, the medium confidence level suggests that investors should remain vigilant for any changes in market conditions or company performance.

DE Economic Analysis

Based on the US economic and market data:

🔴 The recent Non-Farm Payroll data shows a slight increase in employment, but the unemployment rate has risen to 4.3%, indicating potential weakness in the labor market. This could lead to reduced consumer spending, negatively impacting demand for Deere’s products.

🟡 Retail sales have shown a modest increase, but the overall economic growth appears to be slowing, with GDP growth at 5737.189, which is relatively stagnant compared to previous quarters. This could limit Deere’s revenue growth in the near term.

🔴 The CPI data indicates persistent inflation, which could lead to increased costs for Deere’s manufacturing processes. If inflation continues to rise, it may squeeze profit margins, especially if the company cannot pass on these costs to consumers.

🟢 On a positive note, Deere’s strong dividend yield of 1.49% and a solid market cap of approximately 108 billion USD suggest that the company remains financially stable and attractive to income-focused investors.

Overall, while there are some positive indicators regarding Deere’s financial health, the broader economic signals suggest caution. The combination of rising unemployment, inflationary pressures, and stagnant GDP growth could lead to a challenging environment for Deere’s stock price over the next month.

Disclaimer

Investors may consider the AI predictions and news summaries as one factor in their investment decisions alongside their own research and risk tolerance.