HIG Stock Analysis: A Mixed Outlook for Investors

🔴 Recommendation: HIG presents a complex picture for investors, characterized by both bullish trends and cautionary signals, suggesting a hold strategy may be prudent.

📈 Key Highlights:

Trend Analysis: Currently in a bullish trend, trading above both the 50-day and 200-day EMA, indicating strengthening momentum.

Financial Health: Despite a solid revenue base of $6.47 billion, concerns arise from a current ratio of 0.01, indicating significant liquidity risk.

Valuation Metrics: A forward P/E ratio of 9.78 suggests potential undervaluation, making HIG an attractive buy at current levels.

⚠️ Caution Flags:

Decreasing OBV: A declining On-Balance Volume indicates waning buying pressure, raising concerns about the sustainability of the current price levels.

Legal Challenges: Ongoing legal issues could create uncertainty and affect investor sentiment in the short term.

Let’s dive into the details as we break down the price trends, indicators, financial health, valuation metrics, and more 👇

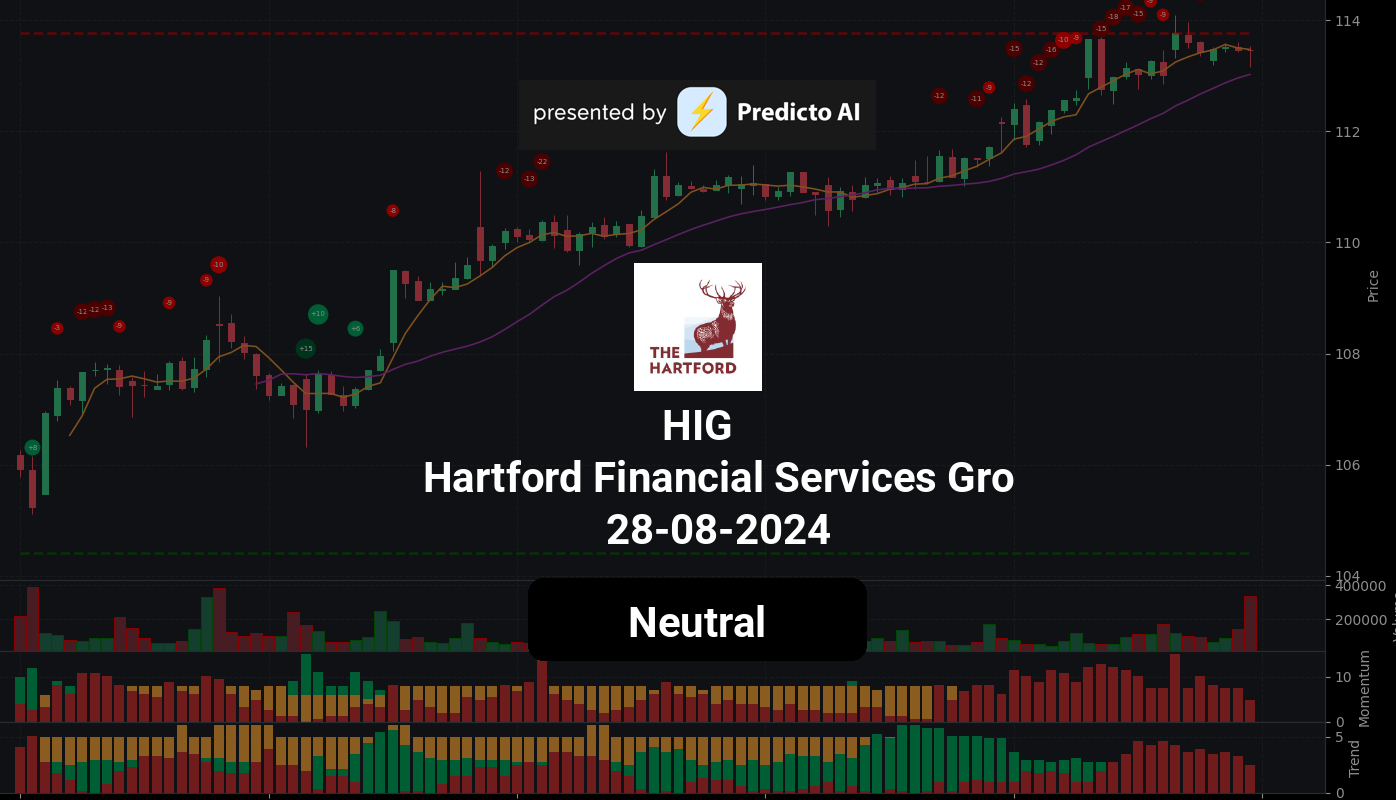

HIG Price Analysis

| Positive Momentum Signals | Negative Momentum Signals | Hold Momentum Signals |

|---|---|---|

|

|

|

| Positive Trend Signals | Negative Trend Signals | Hold Trend Signals |

|---|---|---|

|

|

|

HIG stock presents a complex picture for investors, characterized by both positive and negative indicators. On the positive side, the stock is currently in a bullish trend, as it is trading above both the 50-day and 200-day EMA, indicating a strengthening bullish trend. Additionally, the price is above the middle band of its Bollinger Bands, suggesting an uptrend, although caution is warranted due to potential overbought conditions as the price approaches the upper band.

Momentum indicators also show some positive signs, with the StochRSI indicating oversold conditions, which could suggest a potential rebound. However, the stock’s position is closer to resistance, which raises concerns about the sustainability of its upward movement.

On the downside, the On-Balance Volume (OBV) is decreasing, indicating that the buying pressure may be waning, and high volume is also decreasing, which could signal a lack of conviction in the current price levels. The proximity to resistance further complicates the outlook, as it may limit the stock’s ability to break through to higher levels.

Given these mixed signals, investors should approach HIG stock with caution. While the bullish trends and oversold momentum indicators are encouraging, the decreasing OBV and the stock’s position near resistance suggest that a hold strategy may be prudent until clearer signals of sustained upward momentum emerge.

HIG Fundamental Analysis

HIG’s recent financial performance presents a mixed picture, prompting a cautious outlook for potential investors. The company reported a **net income** of $738 million for the most recent period; however, the **year-over-year trend shows a decrease**, raising concerns about future profitability. Additionally, the **average net debt** stands at a high **$4.2 billion**, which necessitates further scrutiny regarding its impact on financial flexibility and the company’s ability to service its debt.

On a positive note, HIG’s **debt-to-equity ratio** of **0.37** indicates a moderate level of leverage, which may be sustainable depending on the industry context and profitability. However, the **current ratio** is alarmingly low at **0.01**, suggesting significant liquidity risks as the company may struggle to meet its short-term obligations. Furthermore, the **cash to total assets ratio** is **0.00**, indicating limited financial flexibility and increased vulnerability to economic downturns.

From a valuation perspective, HIG shows some promise with a **forward P/E ratio** of **9.78**, suggesting potential undervaluation, and a **price-to-sales ratio** of **1.30**, which indicates that the stock is reasonably priced relative to its sales.

In terms of growth and profitability, the company has achieved a **revenue growth** of **1.09%** year-over-year, which, while modest, could still support stock price appreciation. The **operating margin** is exceptionally high at **100.00%**, reflecting highly efficient operations and excellent cost control. Additionally, the **net profit margin** of **11.41%** demonstrates a strong ability to generate profits after all expenses. However, the decline in net income year-over-year raises valid concerns about the company’s future profitability.

Shareholder information reveals that the **average ordinary shares outstanding** is **300 million**, indicating stability in the number of shares held by investors. The presence of **34 million average treasury shares** may signal management’s confidence in the company’s future prospects through share buybacks.

Examining the income statement, HIG reported **total revenue** of **$6.47 billion**, showcasing a solid revenue base. However, the **year-over-year revenue growth** of **1.09%** is modest and may not excite investors. Notably, the **net interest income** is negative at **$50 million**, indicating that the company is paying more in interest than it is earning, which could be a concern.

On the balance sheet, the **average total debt** of **$4.36 billion** requires further analysis to understand its composition and terms. However, the **average tangible book value** of **$11.91 billion** indicates a solid net worth after liabilities.

In terms of cash flow, HIG has a **positive net cash from financing** of **$422 million**, suggesting that the company is raising capital, which could be utilized for growth or debt reduction. The **average capital expenditures** of **$159 million** indicate that the company is investing in growth and expansion. Additionally, **stock repurchases** totaling **$1.2 billion** can be viewed positively as they reduce the number of shares outstanding and may enhance earnings per share.

In summary, while HIG exhibits several positive indicators such as strong operating margins and reasonable valuation metrics, the concerns regarding liquidity, net income trends, and high debt levels suggest a cautious approach. Therefore, the overall recommendation is neutral. Investors should carefully consider these factors before making any investment decisions regarding HIG stock.

Financial Health

🔴 Net Income for the most recent period was $738 million, but the year-over-year trend shows a decrease, raising concerns about future profitability.

🔴 Average Net Debt is high at $4.2 billion, which warrants further investigation into its impact on financial flexibility and debt servicing capabilities.

🟢 Debt-to-Equity Ratio of 0.37 suggests a moderate level of leverage, which may be sustainable depending on the company’s industry and profitability.

🔴 Current Ratio of 0.01 indicates a significant liquidity risk, as the company may struggle to meet short-term obligations.

🔴 Cash to Total Assets Ratio is 0.00, suggesting limited financial flexibility and vulnerability to economic shocks.

Valuation

🟢 Forward P/E ratio of 9.78 indicates potential undervaluation, suggesting that the stock may be a good buy at current levels.

🟢 Price-to-Sales Ratio of 1.30 is reasonable, indicating that the stock is not excessively priced relative to its sales.

Growth and Profitability

🟢 Revenue Growth of 1.09% year-over-year suggests moderate growth, which could still be positive for stock price appreciation.

🟢 Operating Margin of 100.00% indicates highly efficient operations and excellent cost control.

🟢 Net Profit Margin of 11.41% reflects a strong ability to generate profits after all expenses.

🔴 Year-over-year net income decrease raises concerns about the company’s future profitability.

Shareholder Information

🟢 Average Ordinary Shares Outstanding is 300 million, indicating a stable number of shares held by investors.

🟢 Average Treasury Shares of 34 million may indicate management’s confidence in the company’s future prospects through share buybacks.

Income Statement

🟢 Total Revenue for the most recent period was $6.47 billion, showing a solid revenue base.

🔴 Year-over-year revenue growth of 1.09% is modest and may not excite investors.

🟢 Net Interest Income is negative at $50 million, indicating that the company is paying more in interest than it is earning, which could be a concern.

Balance Sheet

🔴 Average Total Debt of $4.36 billion requires further analysis to understand its composition and terms.

🟢 Average Tangible Book Value of $11.91 billion indicates a solid net worth after liabilities.

Cashflow

🟢 Positive Net Cash from Financing of $422 million indicates that the company is raising capital, which could be used for growth or debt reduction.

🟢 Average Capital Expenditures of $159 million suggest that the company is investing in growth and expansion.

🟢 Stock Repurchases of $1.2 billion can be a positive signal as it reduces the number of shares outstanding and may boost earnings per share.

Overall, while there are some positive indicators such as strong operating margins and reasonable valuation metrics, the concerns regarding liquidity, net income trends, and high debt levels suggest a cautious approach. Therefore, the recommendation is neutral.

HIG News Analysis

HIG News: A mixed outlook for investors.

The news surrounding Hartford Financial Services Group (HIG) presents a mixed outlook for investors. While there are positive developments regarding the company’s performance and price target adjustments, there are also legal challenges that could impact investor sentiment. Overall, the positive news outweighs the negatives, suggesting a cautious but optimistic approach.

🟢 Hartford Financial Services Group’s unit was found correct in terminating a former employee’s long-term disability benefits, which may reduce potential liabilities and legal costs.

🟢 The company has delivered a solid 116% return over the last five years, indicating strong historical performance and investor confidence.

🟢 Evercore ISI has raised its price target on HIG to $110 from $104, reflecting a positive outlook on the stock’s future performance.

🟢 Morgan Stanley also adjusted its price target to $110 from $107, maintaining an equal-weight rating, which suggests stability in the stock’s valuation.

🔴 However, the ongoing legal issues could create uncertainty and affect investor sentiment in the short term.

🟢 The analysis of HIG’s recent performance indicates that it remains a strong player in the property and casualty insurance sector, which is favorable amid rising auto insurance rates.

HIG Holders Analysis

The stock of HIG presents a mixed outlook for the next month, primarily influenced by its high institutional ownership and low insider activity.

🟢 HIG has a **very high institutional ownership** at 95.13%, indicating strong interest from large investors. This suggests a level of confidence in the company’s future performance, as institutional investors typically conduct thorough due diligence before investing.

🔴 However, the **insider ownership is only 0.28%**, which is considered very low. This could imply a lack of confidence from company management or a high degree of external control, potentially leading to volatility if institutional investors decide to sell.

🟡 The **number of institutional holders is substantial at 1302**, which indicates a diversified ownership structure. This can provide some stability, but it also means that any significant sell-off by these institutions could impact the stock price negatively.

🟡 Recent insider transactions show a **higher number of sales compared to purchases**, with a notable percentage of insider sales occurring. This could be interpreted as a lack of confidence in the short-term prospects of the company.

🔴 The overall market conditions and economic factors could also play a role in HIG’s performance over the next month, with potential headwinds from rising interest rates or economic uncertainty.

HIG Analyst Ratings

The analyst ratings for HIG show a mixed sentiment, with a total of 1 strong buy, 6 buy, 11 hold, and no sell or strong sell recommendations. This indicates a cautious optimism among analysts. 🟡 Over the past month, there have been 3 strong buy ratings, 9 buy ratings, and 11 hold ratings, suggesting that while there is some bullish sentiment, a significant number of analysts remain neutral.

🟢 The recent upgrades from firms like Keefe, Bruyette & Woods and RBC Capital indicate a positive outlook for HIG, which could lead to a potential price increase in the coming month. However, the lack of sell or strong sell ratings suggests that analysts are not overly aggressive in their bullish stance.

HIG Economic Analysis

Based on the US economic and market data:

🟢 The **unemployment rate** has increased slightly to **4.3%**, but this is still relatively low, indicating a stable labor market which supports consumer spending.

🟢 **Retail sales** have shown an increase to **627,510**, suggesting healthy consumer demand, which is beneficial for The Hartford’s insurance products as increased economic activity typically leads to higher insurance needs.

🔴 The **CPI** remains high at **314.540**, indicating persistent inflation, which could lead to increased operational costs for The Hartford and pressure on profit margins.

🟢 The **GDP** growth rate is stable, with a recent figure of **5737.189**, indicating a resilient economy that supports the financial services sector.

🟡 The **monthly treasury yield** is at **4.25%**, which is relatively high but still manageable for the insurance sector, as it can lead to better investment returns on premiums collected.

Overall, while there are some inflationary pressures, the underlying economic indicators suggest a stable environment for The Hartford, making it a reasonable buy for the next month. The stock price is currently at **113.46**, with a target mean price of **116.91**, indicating potential upside.

The combination of stable GDP growth, healthy retail sales, and a manageable unemployment rate supports a positive outlook for HIG in the near term.

Disclaimer

Investors may consider the AI predictions and news summaries as one factor in their investment decisions alongside their own research and risk tolerance.