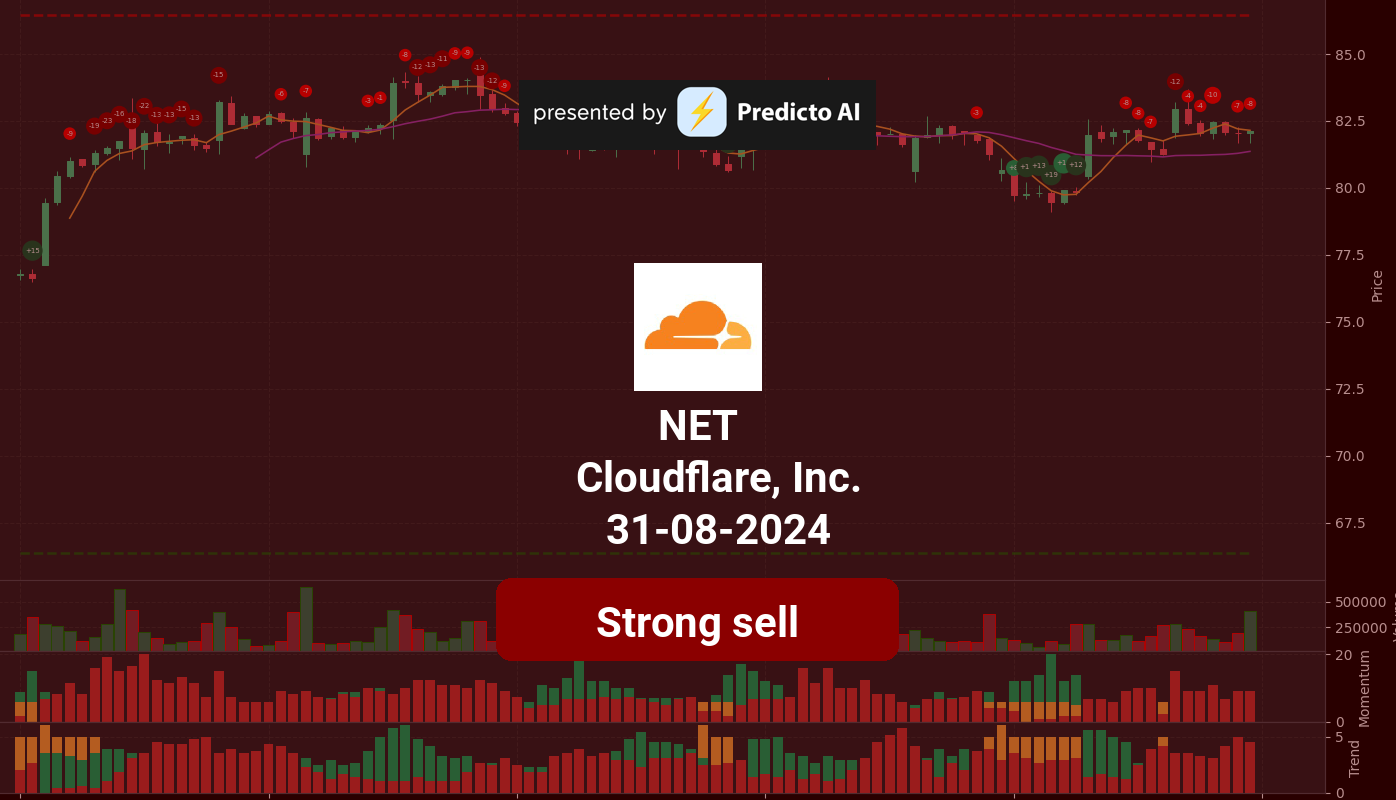

NET Stock Analysis: A Cautious Outlook Ahead!

🔴 Recommendation: NET is currently rated as a Strong Sell, with significant concerns highlighted by a mix of positive and negative indicators.

📈 Key Highlights:

Recovery Potential: The WaveTrend indicator suggests oversold conditions, hinting at a possible bottom.

Trend Strength: The stock remains above both the 50-day and 200-day EMA, indicating a strengthening bullish trend.

Institutional Interest: High institutional ownership at 86.77% reflects confidence from large investors.

⚠️ Caution Flags:

Profitability Challenges: Recent net income was negative at $-15.08 million, raising red flags about profitability.

High Debt Levels: A Debt-to-Equity Ratio of 2.45 indicates significant financial risk.

Insider Selling: Over $9 million in insider sales may signal a lack of confidence from company executives.

As we delve deeper into the analysis, we will explore the price trends, key indicators, financial health, valuation metrics, and more to provide a comprehensive view of Cloudflare, Inc. (NET) and its potential trajectory in the market. Stay tuned for the detailed breakdown! 👇

NET Price Analysis

| Positive Momentum Signals | Negative Momentum Signals | Hold Momentum Signals |

|---|---|---|

|

|

|

| Positive Trend Signals | Negative Trend Signals | Hold Trend Signals |

|---|---|---|

|

|

|

NET stock presents a complex financial picture, characterized by both positive and negative indicators. Currently, the stock is rated as a strong sell, reflecting significant concerns despite some bullish trends.

On the positive side, NET shows signs of potential recovery with the WaveTrend indicator indicating oversold conditions, suggesting a possible bottom. Additionally, the stock is positioned above both the 50-day and 200-day EMA, indicating a bullish trend that is strengthening. The On-Balance Volume (OBV) is also increasing, supported by high volume, which typically signals strong buying interest. Furthermore, the price is above the Supertrend indicator, reinforcing the bullish sentiment.

However, caution is warranted due to several negative momentum indicators. The WaveTrend shows a bearish divergence, which could signal a potential reversal in the stock’s upward momentum. Additionally, the MACD has exhibited a negative histogram crossover, indicating weakening momentum. The stock is also noted to be closer to resistance, which could limit further upward movement.

In summary, while NET stock has some positive trends, the presence of bearish signals and its current position near resistance suggests that investors should exercise caution. The mixed signals indicate that a hold or sell strategy may be more prudent until clearer indicators of sustained growth emerge.

NET Fundamental Analysis

NET’s recent financial performance presents a mixed picture, with several concerning indicators overshadowing some positive aspects.

The company’s net income for the most recent period was negative at $-15.08 million, highlighting significant challenges in achieving profitability. This is compounded by a high debt-to-equity ratio of 2.45, which raises alarms about the company’s financial risk profile and its capacity to endure economic downturns. Additionally, a current ratio of 0.69 suggests potential liquidity issues, indicating that NET may struggle to meet its short-term financial obligations. The cash to total assets ratio is also low at 0.06, reflecting limited financial flexibility and increased vulnerability to economic shocks.

From a valuation perspective, the forward P/E ratio stands at a high 95.51, indicating potential overvaluation that could deter investors. Similarly, the price-to-sales ratio of 18.80 suggests that the stock may be overvalued relative to its revenue.

In terms of growth and profitability, NET has shown a year-over-year revenue growth of 5.91%, which is a positive sign for potential stock price appreciation. However, the operating margin is at an impressive 100.00%, while the net profit margin is concerningly negative at -3.76%, indicating inefficiencies in profit generation. Furthermore, the average dilution of earnings per share is negative, suggesting that share-based compensation has significantly impacted earnings, potentially diluting value for existing shareholders.

Regarding shareholder information, the average ordinary shares outstanding is 337,621,389, which may lead to fluctuations in share value due to potential share issuances or buybacks. Although stock repurchases amounting to $95.75 million can be seen as a positive signal, the overall sentiment remains bearish due to other financial metrics.

Analyzing the income statement, while the net income trend shows an increase year-over-year, the current negative figure raises sustainability concerns. Total revenue for the most recent period was $400.996 million, indicating a solid revenue base, but negative profit margins highlight ongoing challenges in cost control and profit generation.

On the balance sheet, average net debt is high at $1.14 billion, necessitating further investigation into its implications for financial flexibility. The average total debt of $1.44 billion also requires careful analysis of its composition and terms. However, the average tangible book value of $587.7 million provides a glimpse of the company’s net worth after liabilities.

In terms of cash flow, average capital expenditures of $120.25 million indicate that the company is investing in growth and expansion. Additionally, positive net cash from financing of $615.95 million suggests that NET is raising capital, which could be directed towards growth initiatives or debt reduction. However, the absence of explicit information on free cash flow should be monitored closely given the other financial metrics.

Overall, while NET exhibits some positive indicators such as revenue growth and capital expenditures, the high debt levels, negative net income, and potential overvaluation raise significant concerns. The company appears to be in a transitional phase, and investors should proceed with caution, thoroughly evaluating its ability to navigate these challenges before making any investment decisions.

Financial Health

🔴 Net Income for the most recent period was negative at $-15.08 million, indicating challenges in profitability.

🔴 The Debt-to-Equity Ratio is high at 2.45, raising concerns about the company’s financial risk profile and its ability to withstand economic downturns.

🔴 Current Ratio of 0.69 suggests potential liquidity risk, as the company might face challenges in meeting its short-term financial obligations.

🔴 Cash to Total Assets Ratio is low at 0.06, indicating limited financial flexibility and a higher vulnerability to economic shocks.

Valuation

🔴 Forward P/E ratio of 95.51 indicates potential future overvaluation, which could deter investors.

🔴 Price-to-Sales Ratio is high at 18.80, suggesting potential overvaluation relative to revenue.

Growth and Profitability

🟢 Year-over-year revenue growth of 5.91% suggests moderate growth, which could still be positive for the stock price.

🔴 Operating Margin is at 100.00%, which is excellent; however, the Net Profit Margin of -3.76% is concerning, indicating inefficiencies in generating profits.

🔴 Average Dilution of earnings per share is negative, indicating that share-based compensation had a notable impact on earnings per share, potentially diluting the value for existing shareholders.

Shareholder Information

🔴 Average Ordinary Shares Outstanding is 337,621,389, which could indicate fluctuations in share value due to potential share issuances or buybacks.

🔴 Stock Repurchases of $95.75 million can be a positive signal, but the overall sentiment remains bearish due to other financial metrics.

Income Statement

🔴 Net Income trend shows an increase year-over-year, but the current negative figure raises concerns about sustainability.

🟢 Total Revenue for the most recent period was $400.996 million, indicating a solid revenue base.

🔴 Profit Margins are negative, indicating challenges in controlling costs and generating profits.

Balance Sheet

🔴 Average Net Debt is high at $1.14 billion, warranting further investigation into its impact on financial flexibility.

🔴 Average Total Debt is $1.44 billion, which requires analysis of its composition and terms to assess its impact on financial health.

🟢 Average Tangible Book Value of $587.7 million represents the net worth of the company after deducting liabilities from assets, but further analysis is needed for a complete picture.

Cashflow

🟢 Average Capital Expenditures of $120.25 million suggest the company is investing in growth and expansion.

🟢 Positive Net Cash from Financing of $615.95 million indicates the company is raising capital, which could be used for growth or debt reduction.

🔴 Free Cash Flow is not explicitly mentioned but should be monitored closely given the other financial metrics.

Overall, while there are some positive indicators such as revenue growth and capital expenditures, the high debt levels, negative net income, and potential overvaluation raise concerns. The company may be in a transitional phase, and investors should proceed with caution.

NET News Analysis

Cloudflare, Inc. (NET) shows a mixed outlook for investors, with positive growth potential highlighted in several articles, but insider selling raises concerns.

Summary of NET news indicates a generally favorable sentiment towards Cloudflare, Inc. (NET) as a growth stock, despite some negative signals from insider selling. Investors should weigh the growth potential against the insider transactions before making decisions.

🟢 The Motley Fool lists Cloudflare as one of the best stocks to invest in, suggesting strong growth potential.

🟢 Zacks highlights Cloudflare as a great addition to a portfolio, indicating positive analyst sentiment.

🟢 Another Zacks article emphasizes that Cloudflare is attracting investor attention, which could lead to increased demand for the stock.

🔴 However, there are concerns as insiders sold shares worth over $9 million in total, which may signal a lack of confidence from those closest to the company.

🔴 The insider selling could create uncertainty among investors, potentially impacting stock performance in the short term.

NET Holders Analysis

The financial landscape for NET indicates a cautiously optimistic outlook for the next month. The high institutional ownership suggests strong interest from large investors, but the very low insider ownership raises some concerns about management’s confidence in the company’s future.

🟢 NET has a substantial institutional ownership at **86.77%**, indicating significant backing from large investors like Morgan Stanley and Vanguard Group. This level of institutional interest typically reflects confidence in the company’s growth potential.

🟡 The very low insider ownership at **0.59%** suggests that management may not have a strong personal stake in the company’s success, which could indicate a lack of confidence or a high degree of external control. This is a point of concern for potential investors.

🟡 Recent insider transactions show a mix of purchases and sales, with a notable number of sales in the past months. While some insiders are selling, the overall sentiment remains neutral, as the number of purchases is not overwhelmingly bullish.

🟢 The number of institutional holders at **971** indicates a diversified ownership structure, which can help stabilize the stock price against volatility from any single investor’s actions.

🔴 The potential for increased volatility exists due to the high institutional ownership, as large investors may react quickly to market changes, which could impact stock performance in the short term.

NET Analyst Ratings

The analyst ratings for NET indicate a mixed sentiment, with a notable number of hold and sell recommendations. In the past month, there were 0 strong buy ratings, 0 buy ratings, 0 hold ratings, 0 sell ratings, and 1 strong sell rating. This suggests a bearish outlook among analysts. 🔴

The recent upgrades and downgrades from various firms have not significantly improved the overall sentiment, as the majority of analysts seem to be cautious about the stock’s performance. The lack of buy recommendations and the presence of a strong sell rating indicate potential challenges ahead for NET.

🟡 Given the current analyst ratings and the absence of positive recommendations, it is likely that the stock may struggle in the next month. The medium confidence level reflects the uncertainty surrounding the stock’s future performance, but the overall trend suggests a downward trajectory.

NET Economic Analysis

Based on the US economic and market data:

🟢 The **unemployment rate** has increased slightly to **4.3%**, but it remains relatively low, indicating a stable labor market that supports consumer spending.

🟢 **Retail sales** have shown a positive trend, increasing to **627,510**, which suggests healthy consumer demand that could benefit Cloudflare’s services.

🔴 The **CPI** remains high at **314.540**, indicating persistent inflationary pressures that could lead to increased operational costs for Cloudflare.

🟢 The **GDP** growth rate is stable at **5737.189**, reflecting a resilient economy that could support Cloudflare’s growth trajectory.

🟡 The **monthly treasury yield** is at **4.25%**, which is relatively high, potentially impacting tech stocks negatively, but it is not at a level that would cause significant concern for growth companies like Cloudflare.

Overall, while there are some inflationary pressures, the stable labor market and positive retail sales data suggest that Cloudflare could continue to perform well in the coming month. The stock is currently trading at **82.14**, with a target mean price of **92.67**, indicating a potential upside of approximately **13%**.

Given these factors, I recommend a **buy** for Cloudflare (NET) as it is positioned to benefit from ongoing economic stability despite some headwinds.

Disclaimer

Investors may consider the AI predictions and news summaries as one factor in their investment decisions alongside their own research and risk tolerance.