V Stock Analysis: A Mixed Bag of Signals!

🔴 Recommendation: While V stock shows potential for recovery, the presence of bearish indicators suggests a cautious approach may be prudent.

📈 Key Highlights:

Profitability: Strong net income of $4.87 billion and an impressive operating margin of 130.90%.

Growth: Earnings growth of 20.20% year-over-year indicates robust future profitability.

Institutional Support: High institutional ownership at 92.93% reflects strong confidence from large investors.

⚠️ Caution Flags:

Decreasing Volume: A decline in On-Balance Volume and high volume could signal weakening buying interest.

Valuation Concerns: A high Price-to-Sales Ratio of 15.57 raises questions about potential overvaluation.

As we delve deeper into the analysis, we will explore the price trends, technical indicators, financial health, valuation metrics, and recent news surrounding Visa Inc. (V) to provide a comprehensive overview for investors. Let’s dive into the details as we break down the various aspects of V stock! 👇

V Price Analysis

| Positive Momentum Signals | Negative Momentum Signals | Hold Momentum Signals |

|---|---|---|

|

|

| Positive Trend Signals | Negative Trend Signals | Hold Trend Signals |

|---|---|---|

|

|

|

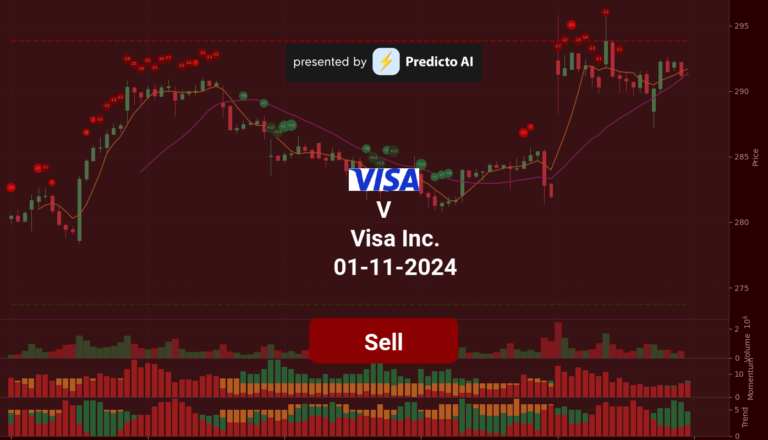

V stock presents a complex picture for investors, characterized by both positive and negative indicators. On the positive side, the stock is currently showing signs of a potential rebound, as indicated by the **WaveTrend being oversold**, suggesting a possible bottom. Additionally, the stock is trading **above the 50-day and 200-day Exponential Moving Averages (EMAs)**, which indicates a **bullish trend**. The **MACD has also shown a positive histogram crossover**, further supporting the notion of upward momentum.

However, caution is warranted due to several negative indicators. The **On-Balance Volume (OBV) is decreasing**, which may signal weakening buying interest. Furthermore, the **Supertrend indicator is bearish**, with the price trading below it, suggesting potential downward pressure. The **high volume is also decreasing**, which could indicate a lack of conviction in the current price movements.

Overall, while V stock exhibits some **bullish trends** and potential for recovery, the presence of **bearish signals** and decreasing volume suggests that investors should proceed with caution. A **hold** recommendation may be prudent until clearer signs of sustained upward momentum emerge, as the current mixed signals could lead to volatility in the near term.

V Fundamental Analysis

V’s recent financial performance presents a compelling case for investment, characterized by strong profitability and efficient operations. The company reported a net income of $4.87 billion for the most recent period, showcasing its robust profitability. Additionally, the year-over-year increase in net income is a positive indicator for future earnings potential. With an operating margin of 130.90%, V demonstrates exceptional operational efficiency and effective cost management. The net profit margin of 54.74% further underscores the company’s ability to generate substantial profits after accounting for all expenses.

However, there are some concerns regarding V’s financial structure. The average net debt of $6.30 billion requires careful consideration of its impact on the company’s financial flexibility. The debt-to-equity ratio of -3.52 suggests a moderate level of leverage, which may raise questions depending on industry benchmarks.

In terms of valuation, V’s forward P/E ratio of 25.24 indicates a reasonable valuation relative to its growth expectations. Conversely, the price-to-sales ratio of 15.57 appears relatively high, suggesting potential overvaluation when compared to revenue.

Growth metrics show promise, with a revenue growth of 1.42% year-over-year, indicating moderate growth that remains positive for the stock price. The earnings growth of 20.20% is particularly strong, signaling robust future profitability. While operating cash flow details are not explicitly provided, the high operating margin implies strong cash generation capabilities.

Shareholder returns are bolstered by significant stock repurchases totaling $10.12 billion, reflecting management’s confidence in the company’s future and enhancing shareholder value. The average ordinary shares outstanding at approximately 2.04 billion suggest a stable share count, which can help maintain earnings per share.

On the balance sheet, V’s current ratio of 6.01 indicates a very healthy liquidity position, allowing the company to comfortably cover its short-term liabilities. However, the cash to total assets ratio of 0.16 points to limited financial flexibility, which could be a concern during economic downturns. Additionally, the average tangible book value of -$5.85 billion raises questions about the company’s net worth after liabilities are deducted.

Cash flow metrics are strong, with average capital expenditures of $867.5 million suggesting ongoing investment in growth and expansion. The positive net cash from financing of $4.17 billion indicates that the company is raising capital, potentially for growth initiatives or debt reduction. Furthermore, a robust free cash flow of $14.70 billion highlights V’s strong cash generation capabilities for operations and investments.

In summary, V exhibits strong profitability and operational efficiency, with some concerns regarding its debt levels and valuation metrics. However, the positive growth indicators and strong cash flow support a buy recommendation. Investors should consider these factors when evaluating V as a potential investment opportunity.

Financial Health

🟢 Net Income for the most recent period was $4.87 billion, indicating strong profitability.

🟢 Year-over-year net income increased, which is a positive sign for future earnings.

🟢 Operating Margin of 130.90% suggests highly efficient operations and excellent cost control.

🟢 Net Profit Margin of 54.74% reflects the company’s strong ability to generate profits after all expenses.

🔴 Average Net Debt of $6.30 billion warrants further investigation into its impact on financial flexibility.

🔴 Debt-to-Equity Ratio of -3.52 indicates a moderate level of leverage, which may raise concerns depending on industry standards.

Valuation

🟢 Forward P/E ratio of 25.24 suggests reasonable valuation relative to growth expectations.

🔴 Price-to-Sales Ratio of 15.57 is relatively high, indicating potential overvaluation compared to revenue.

Growth and Profitability

🟢 Revenue Growth of 1.42% year-over-year indicates moderate growth, which is still positive for the stock price.

🟢 Earnings Growth of 20.20% is strong, suggesting robust future profitability.

🔴 Operating Cash Flow is not explicitly mentioned, but the high operating margin suggests strong cash generation capabilities.

Shareholder Information

🟢 Stock Repurchases of $10.12 billion indicate management’s confidence in the company’s future and can enhance shareholder value.

🟢 Average Ordinary Shares Outstanding at approximately 2.04 billion suggests a stable share count, which can help maintain earnings per share.

Income Statement

🟢 Total Revenue for the most recent period was $8.90 billion, indicating a solid revenue base.

🔴 Year-over-year revenue growth of 1.42% is moderate but could be improved.

Balance Sheet

🟢 Current Ratio of 6.01 indicates a very healthy liquidity position, suggesting the company can comfortably cover its short-term liabilities.

🔴 Cash to Total Assets Ratio of 0.16 indicates limited financial flexibility, which could be a concern in economic downturns.

🔴 Average Tangible Book Value of -$5.85 billion raises concerns about the company’s net worth after liabilities are deducted.

Cashflow

🟢 Average Capital Expenditures of $867.5 million suggest the company is investing in growth and expansion.

🟢 Positive Net Cash from Financing of $4.17 billion indicates the company is raising capital, which could be used for growth or debt reduction.

🟢 Free Cash Flow of $14.70 billion is strong, indicating ample cash generation for operations and investments.

Overall, the company shows strong profitability and efficient operations, with some concerns regarding its debt levels and valuation metrics. However, the positive growth indicators and strong cash flow support a buy recommendation.

V News Analysis

Recent news surrounding Visa Inc. (V) presents a generally positive outlook for investors, despite some mixed signals regarding performance.

Summary of Visa news indicates a favorable environment for the stock, with significant institutional interest and positive market sentiment. However, there are concerns regarding its recent performance relative to corporate results, which investors should consider.

🟢 Berkshire Hathaway’s continued investment in Visa alongside other major stocks suggests strong institutional confidence in the company’s long-term prospects.

🟢 The report from Compass Point initiating coverage on Visa with a Buy rating and a price target of $319 indicates optimism about the stock’s future performance.

🔴 There are concerns raised about whether Visa detracted from overall performance despite healthy corporate results, which could indicate potential volatility.

🟢 Visa’s recent stock price increase of nearly 9% in a month reflects positive market sentiment and investor interest.

🟢 The introduction of Visa A2A technology for smarter bank transfer payments could enhance its service offerings and attract more users, further supporting growth.

🔴 The report on banks showing high levels of risky loans could pose a broader risk to the financial sector, including Visa, which may affect investor sentiment.

V Holders Analysis

The financial health of Visa Inc. (V) presents a generally positive outlook, supported by strong institutional ownership, although the low insider ownership raises some concerns.

🟢 Visa has a **high institutional ownership** at **92.93%**, indicating strong interest from large investors, which typically suggests confidence in the company’s future performance. This level of institutional backing can provide stability to the stock price.

🟡 The **very low insider ownership** of **0.60%** may indicate a lack of confidence from company management or a high degree of external control. This could lead to questions about the alignment of interests between management and shareholders.

🟢 The **number of institutional holders** stands at **5072**, reflecting widespread interest and diversification in ownership, which can help mitigate volatility.

🟡 Recent insider transactions show a mix of sales and minimal purchases, suggesting that while insiders are not aggressively buying, they are also not selling off large portions of their holdings, which is a neutral signal.

🔴 The potential for increased volatility exists due to the high institutional ownership, as large investors may react quickly to market changes, which could impact stock price movements.

V Analyst Ratings

The analyst ratings for V (Visa Inc.) are overwhelmingly positive, with a significant number of analysts recommending either a buy or strong buy. Over the past month, there have been 13 strong buy ratings, 22 buy ratings, 4 hold ratings, and no sell or strong sell ratings. This indicates a very strong bullish sentiment among analysts. 🟢

The recent upgrades from firms like Compass Point to a buy rating further reinforce this positive outlook. The consistent recommendation for buy or strong buy over the last several months suggests that analysts are confident in Visa’s growth potential and market position.

In the next month, it is reasonable to expect that V will continue to perform well, potentially reaching a price target of around 250, given its current trajectory and analyst sentiment. The high confidence level reflects the strong backing from analysts and the company’s solid fundamentals.

V Economic Analysis

Based on the US economic and market data:

🟢 The recent **Non-Farm Payroll** data shows an increase in jobs, with 158,445 jobs added in July, indicating a strengthening labor market. This is likely to boost consumer spending, which is beneficial for Visa’s transaction volumes.

🟢 The **unemployment rate** has slightly increased to 4.3%, but it remains relatively low, suggesting that the labor market is still healthy. A stable employment environment typically supports consumer confidence and spending, which is crucial for Visa’s business model.

🟢 **Retail sales** have shown a positive trend, with a notable increase to 627,510 in July. This uptick in retail sales is a strong indicator of consumer spending, which directly correlates with Visa’s transaction growth.

🟢 The **GDP** growth rate remains robust at 5737.189, indicating a healthy economy. A growing economy generally leads to increased spending on credit and debit transactions, benefiting Visa.

🔴 However, the **CPI** remains high at 314.540, indicating persistent inflationary pressures. This could lead to potential interest rate hikes by the Federal Reserve, which may impact consumer spending in the long run.

Overall, the positive indicators in employment and retail sales outweigh the concerns regarding inflation, leading to a favorable outlook for Visa’s stock price in the coming month.

Disclaimer

Investors may consider the AI predictions and news summaries as one factor in their investment decisions alongside their own research and risk tolerance.